OVERVIEW

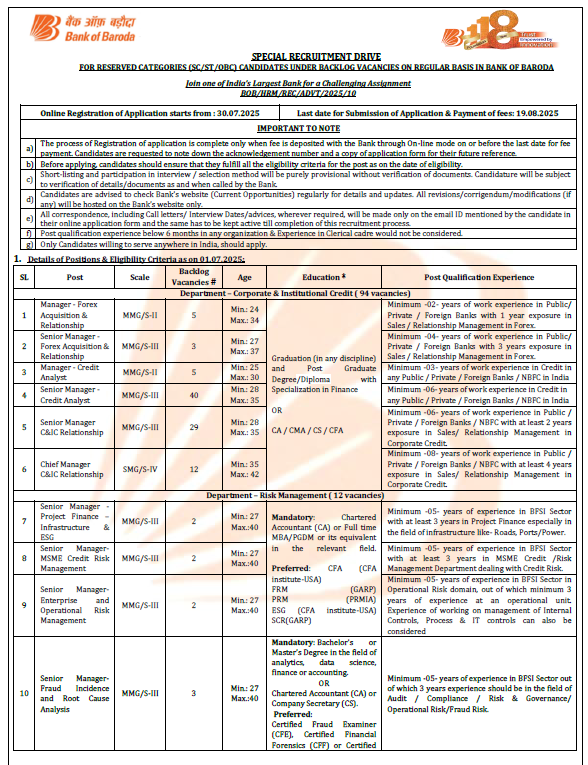

Bank of Baroda has announced a Special Recruitment Drive for Backlog Vacancies for SC/ST/OBC categories on a regular basis. The recruitment is for 125 posts across various departments including Corporate & Institutional Credit, Risk Management, MSME Banking, Security, and Finance. The candidates can apply online from 30th July 2025 to 19th August 2025. Candidates must hold relevant educational qualifications and professional experience, with postings liable anywhere in India. The selection will be through shortlisting followed by interview and/or other methods. A service bond of ₹5 lakhs for 3 years is mandatory for selected candidates.

Important Dates:

| Event | Date |

| Start of Online Application | 30th July 2025 |

| Last Date to Apply & Pay Fees | 19th August 2025 |

Vacancy Details:

The 125 vacancies are distributed across different posts and reserved categories. Some of the key roles include Credit Analyst, C&IC Relationship Manager, Project Finance Manager, and Security Officer. The vacancy table shows exact distribution under SC, ST, and OBC categories.

| Post Name | Scale | Vacancies | SC | ST | OBC |

| Manager – Forex Acquisition & Relationship | MMG/S-II | 5 | 2 | 1 | 2 |

| Senior Manager – Forex Acquisition & Relationship | MMG/S-III | 3 | 1 | 1 | 1 |

| Manager – Credit Analyst | MMG/S-II | 5 | 2 | 3 | 0 |

| Senior Manager – Credit Analyst | MMG/S-III | 40 | 15 | 7 | 18 |

| Senior Manager – C&IC Relationship | MMG/S-III | 29 | 5 | 7 | 17 |

| Chief Manager – C&IC Relationship | SMG/S-IV | 12 | 0 | 5 | 7 |

| Senior Manager – Project Finance (Infra & ESG) | MMG/S-III | 9 | 3 | 1 | 5 |

| Senior Manager – MSME Credit Risk Mgmt | MMG/S-III | 2 | – | – | – |

| Senior Manager – Enterprise & Operational Risk Mgmt | MMG/S-III | 2 | – | – | – |

| Senior Manager – Fraud Incident & Root Cause Analysis | MMG/S-III | 3 | – | – | – |

| Manager – Digital Fraud | MMG/S-II | 3 | 2 | 1 | 0 |

| Manager – Security | MMG/S-II | 10 | 3 | 1 | 6 |

| Senior Manager – MSME Credit | MMG/S-III | 3 | 1 | 0 | 2 |

| Chief Manager – MSME Credit | SMG/S-IV | 3 | 2 | 0 | 1 |

| Senior Manager – Business Finance | MMG/S-III | 1 | 1 | 0 | 0 |

| Chief Manager – Internal Controls | SMG/S-IV | 2 | 1 | 0 | 1 |

Salary Details

| Scale | Pay Scale (₹) | Annual Approx. CTC* |

| MMG/S-II | 64820 – 93960 | ₹13–15 Lakhs |

| MMG/S-III | 85920 – 105280 | ₹17–19 Lakhs |

| SMG/S-IV | 102300 – 120940 | ₹21–23 Lakhs |

Increment Structure:

- MMG/S-II: ₹2340 for 1 year, then ₹2680 for 10 years

- MMG/S-III: ₹2680 for 1 year, then ₹2980 for 5 years

- SMG/S-IV: ₹2980 for 1 year, then ₹3360 for 2 years

Application Fees:

The candidates belongs to UR/EWS/OBC category have to pay 850+charges as application fees. but SC/ST/PWD/ESM/Women candidates need to pay 175+charges as application fees.

| Category | Fees |

| General / EWS / OBC | ₹850/- + charges |

| SC/ST/PWD/ESM/Women | ₹175/- + charges |

Post Qualification Experience:

Candidates must possess relevant degrees (such as Graduate, Postgraduate, CA, MBA, etc.) from recognized institutions. Some posts also prefer additional certifications or technical knowledge relevant to banking, finance, or security domains.

| Post Name | Scale | Post Qualification Experience |

| Manager – Forex Acquisition & Relationship | MMG/S-II | Min. 2 years in banks; 1 year in Forex Sales/Relationship |

| Senior Manager – Forex Acquisition & Relationship | MMG/S-III | Min. 4 years in banks; 3 years in Forex Sales/Relationship |

| Manager – Credit Analyst | MMG/S-II | Min. 3 years in Credit in Banks/NBFCs |

| Senior Manager – Credit Analyst | MMG/S-III | Min. 6 years in Credit in Banks/NBFCs |

| Senior Manager – C&IC Relationship | MMG/S-III | Min. 6 years in Banks/NBFCs; 2 years in Corporate Credit Sales/Relationship |

| Chief Manager – C&IC Relationship | SMG/S-IV | Min. 8 years in Banks/NBFCs; 4 years in Corporate Credit Sales/Relationship |

| Sr. Manager – Project Finance (Infra & ESG) | MMG/S-III | Min. 5 years in BFSI; 3 years in Infra Project Finance |

| Sr. Manager – MSME Credit Risk Mgmt | MMG/S-III | Min. 5 years in BFSI; 3 years in MSME Credit/Risk |

| Sr. Manager – Enterprise & Operational Risk Mgmt | MMG/S-III | Min. 5 years in BFSI; 3 years in Operational Risk |

| Sr. Manager – Fraud Incidence & RCA | MMG/S-III | Min. 5 years in BFSI; 3 years in Audit/Compliance/Risk/Fraud |

| Manager – Digital Fraud | MMG/S-II | Min. 3 years in IT/Digital Banking; Fraud Risk preferred |

| Manager – Security | MMG/S-II | Min. 5 years as Officer in Armed Forces / Police / Paramilitary |

| Sr. Manager – MSME Credit | MMG/S-III | Min. 6 years in Corporate/MSME Credit (5 years for CA/CMA) |

| Chief Manager – MSME Credit | SMG/S-IV | Min. 9 years in MSME Credit (8 years for CA/CMA/CFA) |

| Sr. Manager – Business Finance | MMG/S-III | Min. 6 years in Business Finance in Bank/NBFC |

| Chief Manager – Internal Controls | SMG/S-IV | Min. 8 years in Internal Control/Audit in Big 4 or major firm |

Age Limit:

The minimum age varies from 23 to 30 years, and the maximum age from 34 to 42 years depending on the post. Relaxation in upper age limit is applicable for SC/ST/OBC/PwD/Ex-Servicemen as per government rules.

| Post Name | Minimum Age | Maximum Age |

| Manager – Forex Acquisition & Relationship | 24 years | 34 years |

| Senior Manager – Forex Acquisition & Relationship | 27 years | 37 years |

| Manager – Credit Analyst | 25 years | 30 years |

| Senior Manager – Credit Analyst | 28 years | 35 years |

| Senior Manager – C&IC Relationship | 28 years | 35 years |

| Chief Manager – C&IC Relationship | 35 years | 42 years |

| Senior Manager – Project Finance – Infra & ESG | 27 years | 40 years |

| Senior Manager – MSME Credit Risk Management | 27 years | 40 years |

| Senior Manager – Enterprise & Operational Risk | 27 years | 40 years |

| Senior Manager – Fraud Incidence & RCA | 27 years | 40 years |

| Manager – Digital Fraud | 24 years | 34 years |

| Manager – Security | 23 years | 35 years |

| Senior Manager – MSME Credit | 27 years | 37 years |

| Chief Manager – MSME Credit | 28 years | 40 years |

| Senior Manager – Business Finance | 28 years | 38 years |

| Chief Manager – Internal Controls | 30 years | 40 years |

- Age relaxation as per govt norms:

| Category | Relaxation |

| Scheduled Caste / Scheduled Tribe | 5 years |

| OBC (Non-Creamy Layer) | 3 years |

| PwD (SC/ST) | 15 years |

| PwD (OBC) | 13 years |

| Ex-Servicemen (SC/ST) | 10 years |

| Ex-Servicemen (OBC) | 8 years |

| 1984 Riot-affected persons | 5 years |

Selection Process:

- Shortlisting

- Based on qualification, experience, and overall suitability for the post.

- Shortlisting does not confirm final selection.

- Selection Process

May include one or more of the following:- Personal Interview (PI)

- Group Discussion (GD)

- Psychometric Test

- Online Test (at the Bank’s discretion)

- Evaluation Parameters

- Personality

- Communication

- Clarity & Problem-Solving

- Efficiency

- Willingness to work anywhere in India

- Suitability for the role

- Merit Criteria

- Minimum qualifying marks in GD/PI: 55%

- Must qualify in all stages

- Final merit list prepared based on marks in interview and/or other methods

- Tie-Breaking Rule

- If multiple candidates score the same cut-off marks, older candidate (by age) is ranked higher.

- Additional Notes

- Bank may change the selection method at its sole discretion.

- Bank reserves the right to combine two or more positions into one.

- Candidates may be considered for other suitable positions if eligible.

How to Apply:

- Visit the Official Website

- Go to: www.bankofbaroda.in

- Navigate to Careers → Current Opportunities

- Register Online

- Click on the relevant advertisement link.

- Register yourself with a valid email ID and mobile number.

- Fill the Online Application Form

- Enter personal, educational, and professional details.

- Upload required documents (see list below).

- Upload Required Documents

- Scanned photograph & signature

- Resume (PDF)

- Date of Birth proof (10th certificate/mark sheet)

- Educational certificates (all in one PDF)

- Experience certificates

- Caste/Category certificate (if applicable)

- PwBD certificate (if applicable)

- Pay the Application Fee

- Use Debit/Credit Card, Net Banking, or UPI

- Fee:

- ₹850/- for OBC

- ₹175/- for SC/ST/PwBD/ESM/Women

- Submit the Application

- Verify all details carefully before submitting.

- Once submitted, no changes are allowed.

Important Documents:

document verification, the following are required:

- Application Acknowledgement (printed after online submission)

- Valid Photo ID Proof (Aadhar, Passport, Voter ID, etc.)

- Proof of Date of Birth

- Educational Qualification Certificates

- Caste/Category Certificate (SC/ST/OBC-NCL/EWS)

- Non-Creamy Layer Certificate (for OBC-NCL)

- EWS Certificate (if applicable)

- Disability Certificate (if applicable)

- Experience Certificate / NOC

Important links

| Event | Date |

|---|---|

| Notification Release | 30th July 2025 |

| Apply Online Start | 30th July 2025 |

| Last Date to Apply | 19th August 2025 |

| Download Notification | Click Here |

| Official Websites | Click Here |

How many total vacancies are available under this recruitment drive?

A total of 125 vacancies are available for various managerial-level posts across different categories.

What is the last date to apply for BOB Special Recruitment 2025?

The last date to submit the online application and pay the fees is 19th August 2025.

When does the online application process start?

The online application process begins on 30th July 2025 on the official website of Bank of Baroda.

Is prior work experience mandatory for all posts?

Yes, post-qualification experience ranging from 2 to 9 years (depending on the post and scale) is mandatory.